How Top Tulsa Bankruptcy Lawyers can Save You Time, Stress, and Money.

Table of Contents3 Simple Techniques For Bankruptcy Lawyer TulsaAbout Chapter 7 - Bankruptcy BasicsThe Basic Principles Of Tulsa Bankruptcy Consultation Facts About Experienced Bankruptcy Lawyer Tulsa RevealedSee This Report on Top Tulsa Bankruptcy Lawyers

The stats for the various other main kind, Chapter 13, are also worse for pro se filers. (We damage down the distinctions between both enters depth below.) Suffice it to state, speak to an attorney or 2 near you that's experienced with bankruptcy legislation. Right here are a few sources to discover them: It's easy to understand that you may be hesitant to spend for a lawyer when you're already under substantial monetary stress.Many lawyers also supply cost-free examinations or email Q&A s. Capitalize on that. (The non-profit app Upsolve can assist you locate complimentary examinations, sources and legal assistance absolutely free.) Ask if insolvency is certainly the appropriate option for your situation and whether they assume you'll qualify. Before you pay to file bankruptcy types and acne your credit report for approximately 10 years, check to see if you have any practical options like financial debt settlement or charitable credit history therapy.

Ads by Money. We might be compensated if you click this ad. Ad Now that you have actually determined personal bankruptcy is undoubtedly the appropriate strategy and you hopefully removed it with an attorney you'll need to begin on the paperwork. Before you dive right into all the official personal bankruptcy kinds, you should get your own files in order.

Bankruptcy Attorney Near Me Tulsa Fundamentals Explained

Later down the line, you'll really require to verify that by revealing all kind of details about your monetary affairs. Below's a fundamental checklist of what you'll need on the road ahead: Identifying files like your chauffeur's license and Social Protection card Income tax return (as much as the past 4 years) Evidence of income (pay stubs, W-2s, self-employed revenues, revenue from properties along with any kind of income from government benefits) Bank statements and/or retirement account declarations Proof of worth of your assets, such as car and property evaluation.

You'll want to comprehend what type of debt you're attempting to solve.

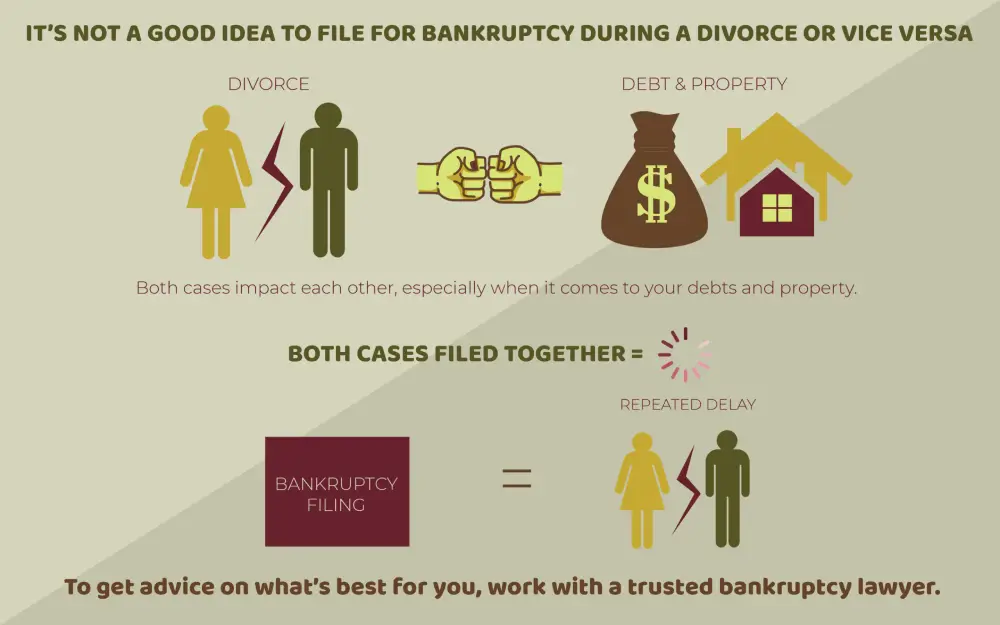

You'll want to comprehend what type of debt you're attempting to solve.If your earnings is as well high, you have an additional choice: Phase 13. This option takes longer to solve your financial obligations because it needs a long-lasting settlement plan normally three to five years before several of your continuing to be debts are cleaned away. The declaring process is likewise a whole lot extra complex than Phase 7.

Affordable Bankruptcy Lawyer Tulsa for Dummies

A Phase 7 insolvency remains on your credit report for one decade, whereas a Chapter 13 personal bankruptcy diminishes after 7. Both have lasting impacts on your credit report, and any new debt you obtain will likely come with greater rates of interest. Prior to you send your insolvency forms, you have to first finish a necessary program from a credit history therapy company that has been approved by the Department of Justice (with the significant exemption of filers in Alabama or North Carolina).

The program can be completed online, in individual or over the phone. Training courses normally set you back in between $15 and $50. You need to complete the course within 180 days of declare personal bankruptcy (Tulsa bankruptcy attorney). Make use of the Division of Justice's internet site to locate a program. If you stay in Alabama or North Carolina, you have to choose and finish a program from a checklist of independently authorized providers in your state.

The Buzz on Tulsa Bankruptcy Consultation

An attorney will commonly handle this for you. If you're filing on your own, recognize that there have to do with 90 various personal bankruptcy areas. Inspect that you're submitting with the correct one based upon where you live. If your copyright has actually relocated within 180 days of filling up, you should submit in the area where you lived the greater section of that 180-day duration.

You will certainly need to offer a prompt listing of what certifies as an exemption. Exemptions might put on non-luxury, main automobiles; required home products; and home equity (though these exemptions regulations can differ extensively by state). Any building outside the checklist of exceptions is considered nonexempt, and if you do not offer any type of list, then all your building is thought about nonexempt, i.e.

You will certainly need to offer a prompt listing of what certifies as an exemption. Exemptions might put on non-luxury, main automobiles; required home products; and home equity (though these exemptions regulations can differ extensively by state). Any building outside the checklist of exceptions is considered nonexempt, and if you do not offer any type of list, then all your building is thought about nonexempt, i.e.The trustee wouldn't sell your cars to right away pay off the creditor. Instead, you would pay your creditors that Discover More amount over the training course of your payment plan. A typical mistaken belief with personal bankruptcy is that when you submit, you can quit paying your financial debts. While insolvency can help you erase much of your unsecured debts, such as overdue medical costs or individual lendings, you'll want to keep paying your regular additional info monthly payments for protected financial obligations if you desire to maintain the residential or commercial property.

Tulsa Bankruptcy Filing Assistance Fundamentals Explained

If you go to danger of foreclosure and have worn down all various other financial-relief options, after that filing for Phase 13 may delay the repossession and conserve your home. Inevitably, you will certainly still require the revenue to continue making future home loan settlements, as well as repaying any kind of late payments throughout your layaway plan.

If so, you may be called for to offer added details. The audit could delay any kind of financial debt relief by numerous weeks. Of program, if the audit turns up wrong info, your case might be dismissed. All that said, these are rather rare circumstances. That you made it this much in the procedure is a respectable indication at least a few of your financial debts are eligible for discharge.

Comments on “The Ultimate Guide To Chapter 7 Bankruptcy Attorney Tulsa”